Legal updates and opinions

News / News

A Guide to The Johannesburg High Court – dedicated Insolvency Court Project

Published On: April 11th, 2025 by Eric Levenstein, Director and Head of Business Rescue & Insolvency, Amy Mackechnie, Senior Associate and Kaymana Han, Candidate Attorney

INTRODUCTION

1. In a landmark step to revolutionise insolvency litigation in South Africa, the Johannesburg High Court has launched a Pilot Dedicated Insolvency Court. Effective from 14 April 2025, this initiative establishes two specialist structures – the Insolvency Motion Court (“IMC”) and the Insolvency Trial Court (“ITC”). The new insolvency court will exclusively manage all insolvency-related applications and trials with the goal of improving efficiency, turnaround times and legal certainty.

PURPOSE

2. This publication outlines the structure, scope, procedures, and timelines associated with the new court. It is intended as a practical guide for practitioners navigating this shift in insolvency proceedings.

THE INSOLVENCY MOTION COURT (“IMC”)

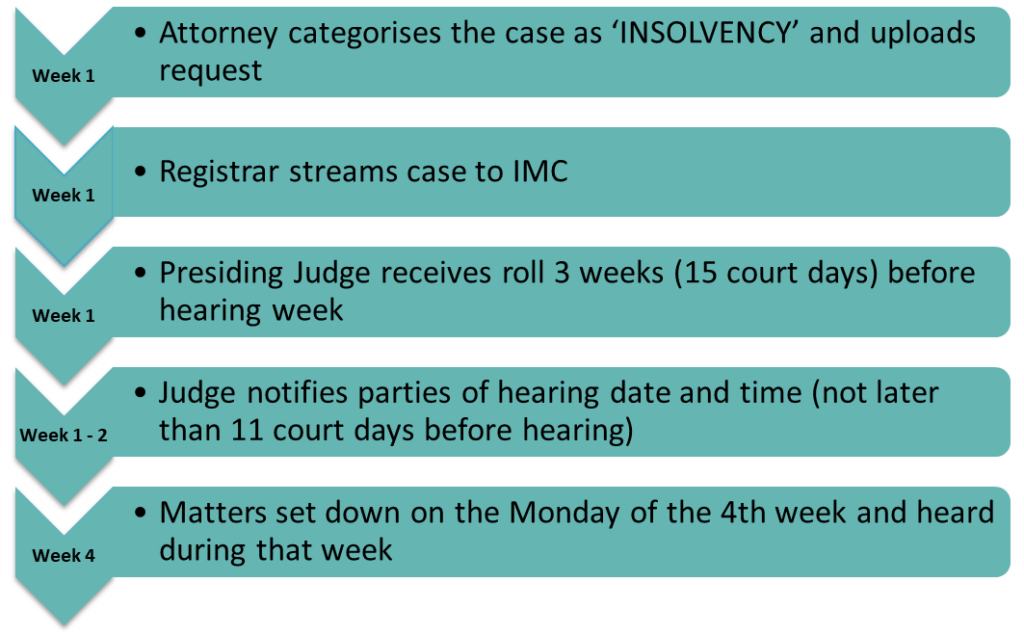

3. The IMC will hear all applications relating to: Sequestration proceedings Rehabilitation proceedings Liquidation proceedings Business rescue proceedings Extension of powers of provisional liquidators Perfection of security (e.g., notarial bonds) Reviews of decisions by the Master of the High Court Interlocutory applications and exceptions in insolvency matters. 4. Enrolments open on 14 April 2025. Hearings commence the week of 12 May 2025. All insolvency matters already enrolled on other motion rolls will automatically be redirected to the IMC. 5. The IMC will follow a 4-week cycle.

| Week / Timing | Action / Description |

| Week 1 | Request for enrolment is uploaded by the applicant’s attorney, categorised as ‘INSOLVENCY’. |

| Week 1 (15 court days before hearing) | Presiding judge receives the roll from the registrar. |

| During Week 1 (not later than 11 court days before set down) | Judge notifies the parties of the date and time of hearing. |

| Week 4 | Matter is formally set down on Monday and heard during that week. |

6. Urgent applications will only be entertained in exceptional circumstances. The urgent motion court will no longer hear insolvency matters during term time. During recess, the senior judge will decide whether to allocate urgent matters to the IMC or the urgent motion court.

7. To qualify for urgency: Matters must meet standard urgency criteria Interim relief or rule nisi should be sought in the application Papers must be concise and focused

8. Matters that require oral evidence or are too complex or voluminous for the IMC, may be referred to the Deputy Judge President for special allocation. THE INSOLVENCY TRIAL COURT (“ITC”)

9. The ITC will hear trials involving: Impeachment of dispositions Section 424 action proceedings in terms of the Companies Act, 1973; Other actions substantially related to insolvency

10. Parties must ensure the matter is trial-ready in line with practice directives and approach the Deputy Judge President with a motivated request for a trial date. STRATEGIC IMPACT

11. The Dedicated Insolvency Court promises greater speed, efficiency, legal specialisation, and commercial sensibility. It marks a shift towards a litigation environment that recognises the urgency and nuance of insolvency, business rescue and related matters.

12. Practitioners should become familiar with the process and adapt swiftly to leverage this specialised forum for the benefit of their clients.

FLOW CHART INDICATING THE TIME PERIODS IN THE DEDICATED INSOLVENCY MOTION COURT

Latest News

Privacy: human right or fallacy in the digital world?

"The real question is, when will we draft an artificial intelligence bill of rights? What will that consist of? And [...]

Communities in the centre of the mining revolution: Land issues dog inclusive mining

Marking its 30th anniversary of the Investing in Mining Indaba in Cape Town, which incidentally coincides with South Africa's 30 [...]

Werksmans Technology Media and Telecommunications Africa Quarterly e‑Bulletin

This e-bulletin highlights key legislative and regulatory developments in the technology, media and telecommunications sectors in sub-Saharan Africa. This issue [...]

No time for dark humour in the workplace – Load shedding is no joke!!

and Tasreeq Ferreira - Candidate Attorney Issue Whether an employee's dismissal for posting a WhatsApp message, purporting to be from [...]

The downside to a side hustle – moonlighting, conflicts of interest and the law

and Nombulelo Bashe – Candidate Attorney Employees are required to devote their time, effort and skills to advance their employer's business [...]

Mystery of the momentary visitor: Solving the uncertainty surrounding the replacement of an interim business rescue practitioner

A company can be placed in business rescue in only two ways, voluntarily by a board resolution in terms of [...]